One of the most common ways to finance a car purchase is to take out a car loan. But if you can arrange it with your employer, there is another option; a novated lease

Novated Leasing Calculator.

Each of these options are different, even if there are some similarities. Both require you to make regular payments and offer the option to leave a balloon or residual value to pay at the end of the term.

Both a novated lease and car finance can be used to buy a car for personal use. However, if you choose a car loan, you own the vehicle from the first day. If you opt for a novated lease, you become the owner once you pay the car’s residual value at the end of the term.

What is a novated lease?

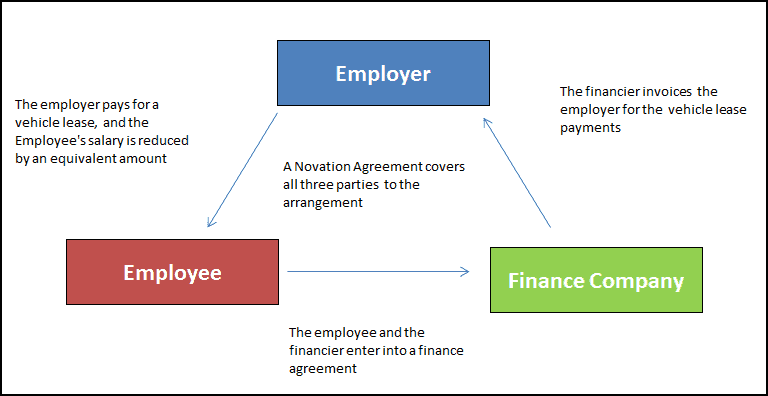

A novated lease is a three-way arrangement between you, your employer, and the lender, using your pre-tax income as a salary sacrifice. A fully maintained novated lease can also cover the cost of running expenses such as fuel and maintenance, as well as the vehicle itself.

In a novated lease, you borrow from the leasing company and pay off the amount over a set period. Your employer makes payments directly from your pre-tax salary over the lease period, which is generally between two and five years.

At the end of the novated lease period, there is typically a residual amount left to pay, and a few options available to settle it:

What is a car loan?

A car loan is a type of personal loan that you can use to buy a new or a used vehicle if you can’t afford to pay for one upfront. There are different types of car loans for buying new or used vehicles, and the average car loan term is about seven years. During the term, you’ll need to make regular repayments to pay off the lump sum you borrowed (the principal), as well as interest charges. You can use a car loan calculator to estimate your rep