If you lease a passenger vehicle to earn income, you can claim a "portion if not all" of your lease payments on your taxes. Keep reading to find out what you need to know about deducting car lease payments on your next CRA tax return

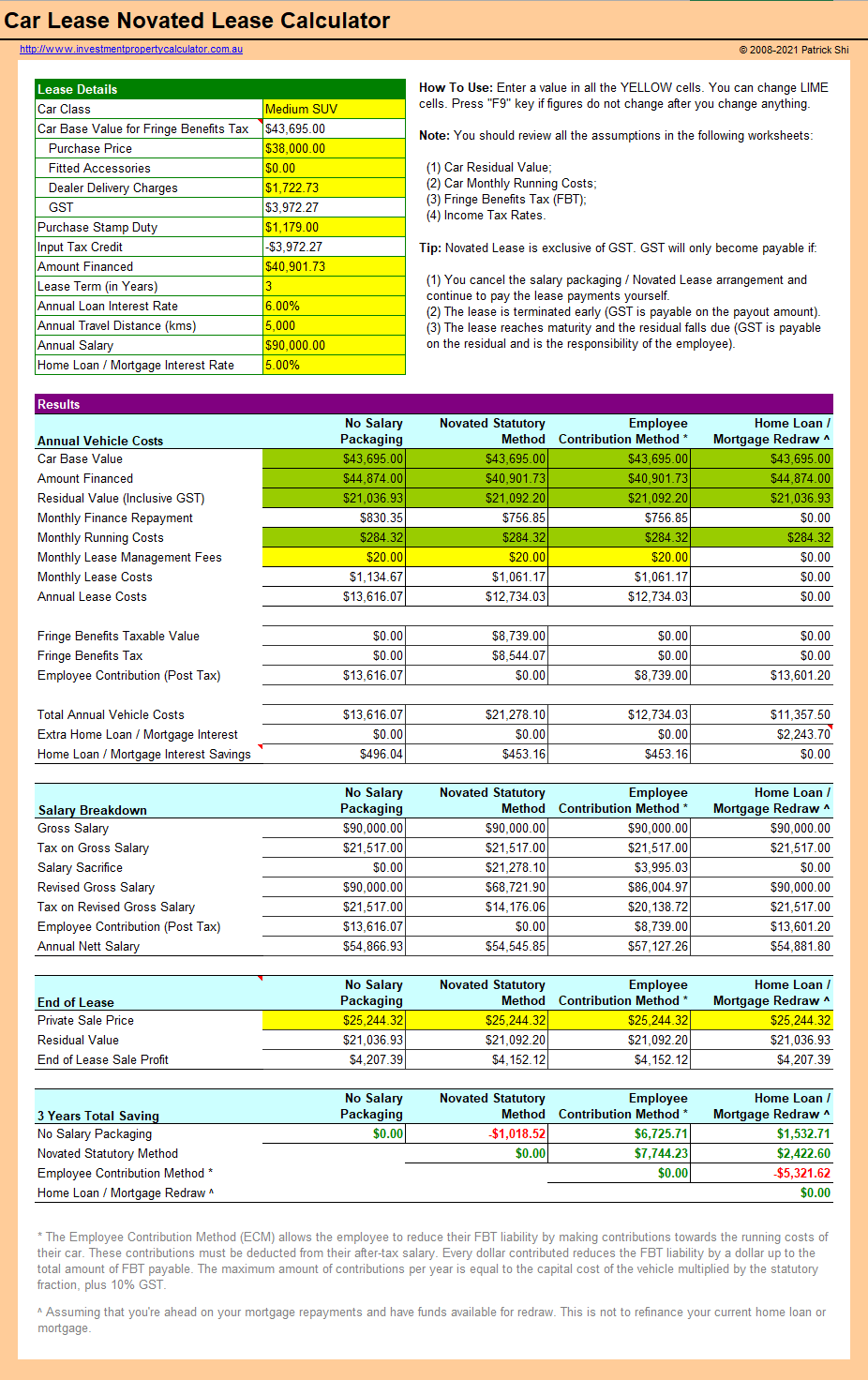

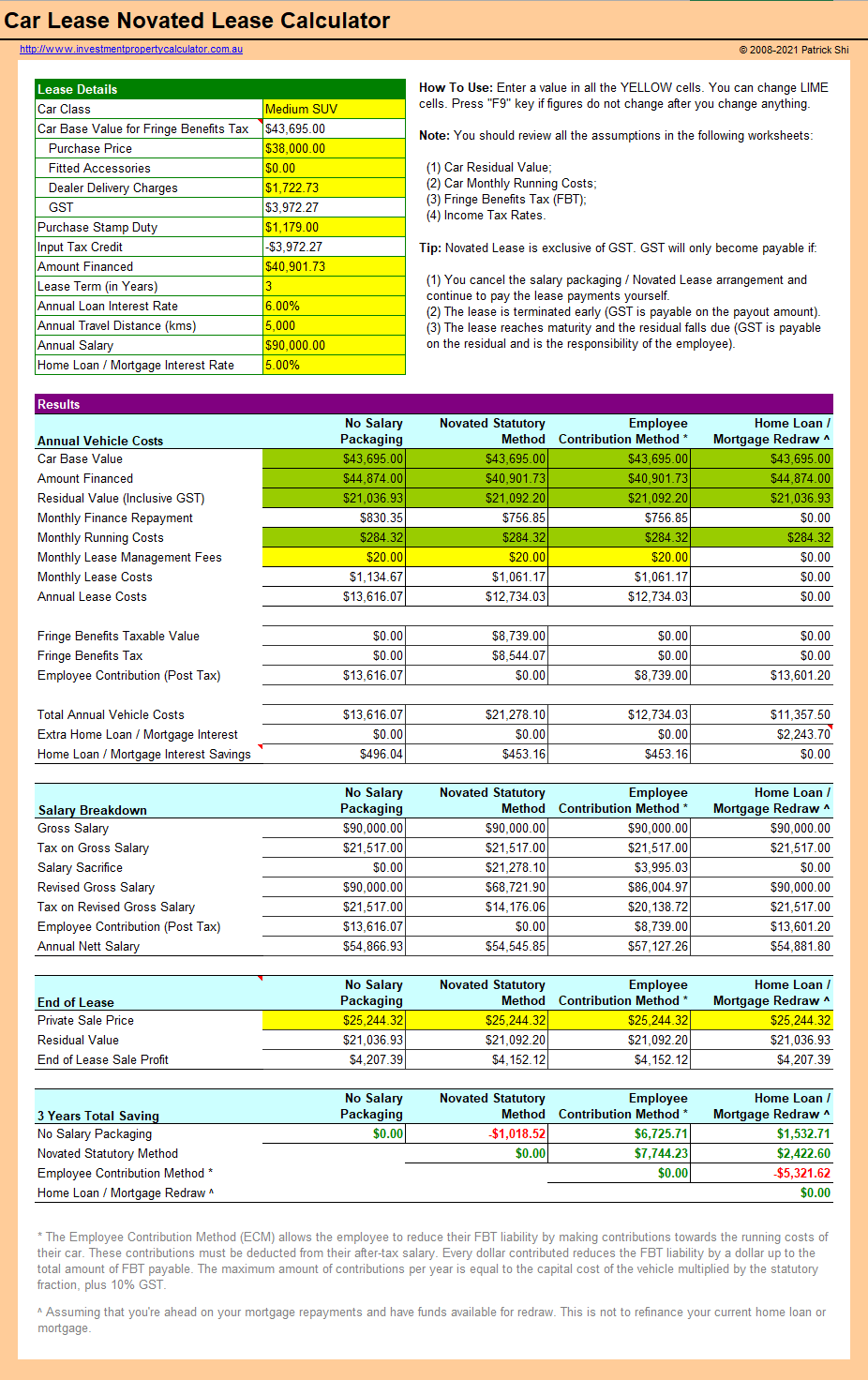

Novated Lease Repayment Calculator.

Are car lease payments tax deductible?

Are car lease payments tax deductible?

Individuals who lease a passenger vehicle for work-related purposes can deduct part of their leasing costs on their tax return. That being said, there is a limit on the amount you can claim. This limit is based on a calculation involving your lease payments and the value of your car. To figure out your eligible leasing costs, use Chart C of Form T2125, Statement of Business or Professional Activities. Look for the heading that reads, "Eligible leasing cost for passenger vehicles." In most cases, your lease will include sales taxes (GST/PST/HST) but will exclude insurance and maintenance for your vehicle. For the purposes of filling out Form T2125, make sure to enter your lease payment amounts before taxes on lines 19 and 20. You can deduct vehicle insurance and maintenance costs under Chart A (Motor vehicle expenses) of the same form.

How to calculate your car lease deduction

Scenario: calculating car lease deduction

How to calculate your car lease deduction

Scenario: calculating car lease deduction

Your eligible leasing cost is the lesser amount of line 24 or 25. In this case, you would be entitled to claim $3,000. Keep a record of this number, since you will need to input it on line 20 of Chart C if you continue to lease your vehicle next year. Please note that the above calculation implies that the vehicle will only be used for business purposes, meaning that 100% of lease costs are deductible. If you use your car for personal drives 50% of the time, you will only be able to claim 50% of your lease costs on your income tax return. To make things a little easier, consider using an application like MileIQ to track your business drives!

Repayments and imputed interest

If you made one or more deposits to lease your vehicle, you may have a repayment owing to you. In addition, if the value of these deposits is more than $1,000, you may have imputed interest coming your way. In this situation, you will not be able to use Chart C of Form T2125.

Tax benefits of leasing a car

If you buy a car for business purposes in Canada, you will be able to claim the Capital Cost Allowance (CCA), which is a vehicle depreciation deduction. That being said, CCA only lets you claim part of the value of your car each year. When you lease a car, however, things are a bit different. If you use your car for business purposes all of the time, you may be able to deduct 100% of your lease payments for tax purposes. In other words, from a tax perspective, leasing a new car can be more beneficial than buying a brand-new car at the end of the year.