An example of a novated lease arrangement

If you get paid $70,000 per year (before tax) and your novated lease payments amount to $10,000, your taxable income becomes $60,000 (if you pay all of your novated lease payments from your pre-tax salary). This means you’ll pay less tax over the year. Your finance provider or an accountant can help you to work out the potential savings and the other things you’ll need to consider before entering into a novated lease based on your personal circumstances

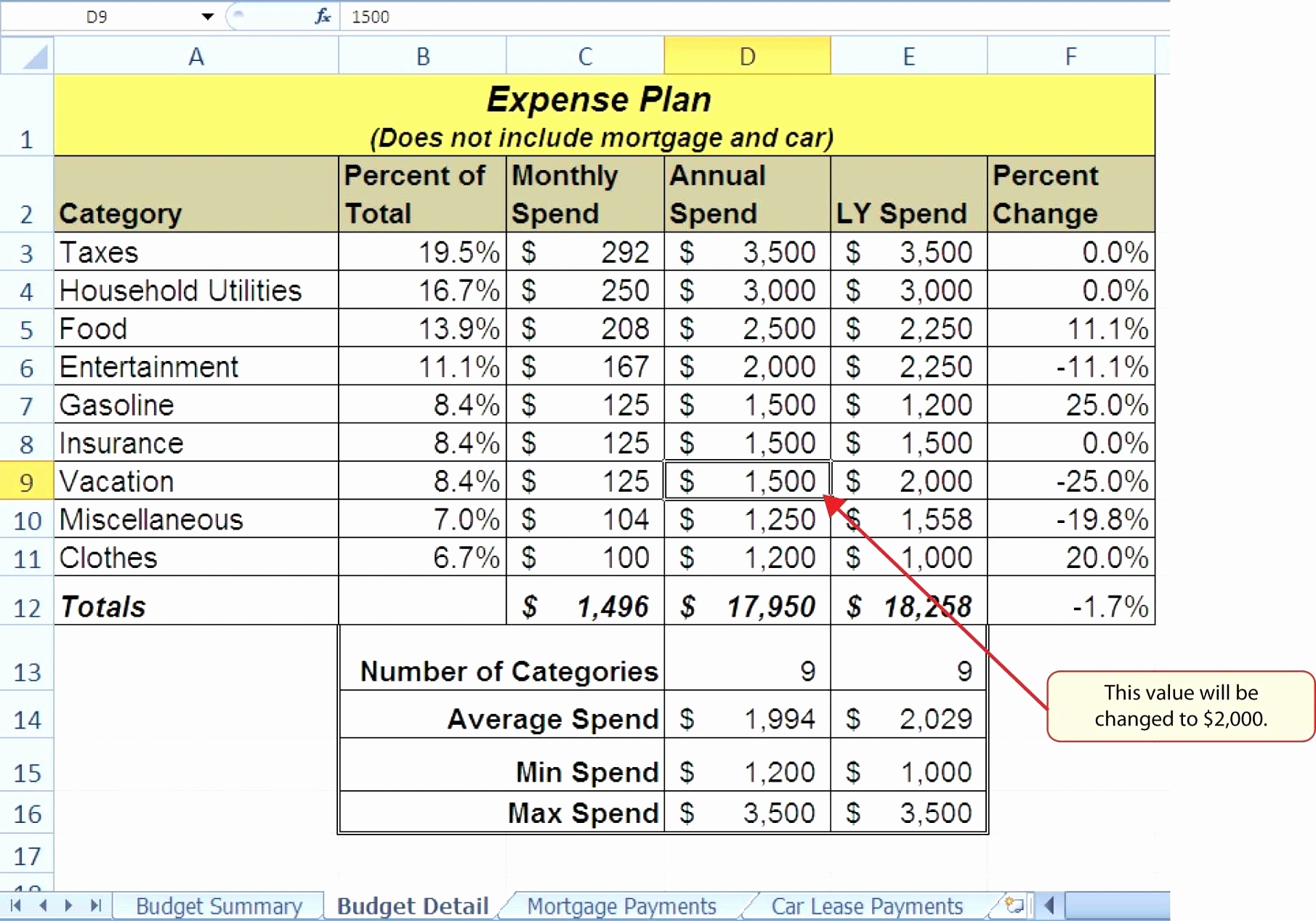

Novated Lease Repayment Calculator.

https://www.finder.com.au/finder-au/...at.png?fit=750

Keep in mind that if you change jobs or stop working, the responsibility for making the repayments remains with you. You may be able to transfer your lease to your new employer, but you may also have to take over the repayments (which may no longer be pre-tax).

When you have a car under a novated lease with your employer, the Federal Government considers it to be a fringe benefit. Fringe benefits tax may then apply. While employers are liable to pay fringe benefits tax in the case of novated leases, this cost is generally passed on to you from your pre-tax salary.

It’s important to understand how this and any other financial implications arising from entering into a novated lease can impact you, so seek help from an accountant or financial adviser.