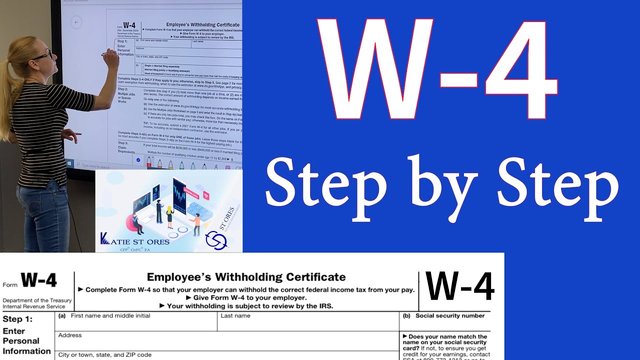

Irs Form W-4 Walkthrough® - Tax Prep, Forms & Real Examples

Published 7/2025

Created by Philip J. CPA

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz, 2 Ch

Level: All | Genre: eLearning | Language: English | Duration: 20 Lectures ( 2h 0m ) | Size: 1.57 GB

Tax Preparation Course: Tax Forms (W-4), Real-World Examples, Infographics, Quizzes & Practice Tests

What you'll learn

How IRS Federal Tax Withholdings Work

What IRS Form W-4 Is and Why It Matters

How to Complete Each Step of Form W-4

Using the IRS Tax Withholding Estimator

Adjusting for Multiple Jobs or Spouse's Income

Claiming Dependents for Withholding Purposes

Other Adjustments: Deductions, Tax Credits, and Extra Withholding

How to Estimate Your Tax Liability

How to Avoid Underpayment Penalties

How Life Changes Affect Withholding (Marriage, Divorce, Birth, Job Change)

When and How to Submit a W-4 Form

Understanding Paycheck Impact from W-4 Changes

How to Calculate Withholding Using a Tax Formula

How to Calculate Withholding Using a Tax Formula

Common W-4 Mistakes and How to Avoid Them

W-4 Strategy for Side Income or Self-Employment

How to Coordinate W-4 With Estimated Tax Payments

How to Coordinate W-4 With Estimated Tax Payments

Requirements

No Tax Experience Needed

Description

This course will focus on tax planning and preparation related to IRS Form W-4, the Employee Tax Withholdings used by taxpayers to adjust the amount of federal income tax withheld from their paycheck.We will look at each new concept from multiple angles, starting with a presentation discussing the topic and then looking at examples to better understand the concepts in action.Each section will use tax forms to work through real-world scenarios and an accounting equation method using Excel so learners can understand the impact of withholding decisions on a tax return and visualize the tax formula in action.Completing Form W-4 accurately is essential for taxpayers to avoid large tax due balances or unexpected refunds. This course will begin by introducing the purpose and structure of Form W-4, including the relationship between withholding, income, tax liability, and credits.Learners will understand how to complete each step of the W-4 form, including considerations for multiple jobs, spouses working, dependents, and other adjustments. We will walk through common scenarios to illustrate how different life and financial situations affect withholding recommendations.The course will explain the IRS Tax Withholding Estimator and how it can be used to align withholding with actual tax liability, especially after changes in income, family size, or deductions.We will also discuss strategies for adjusting withholding mid-year, how to avoid underpayment penalties, and how to reconcile withheld tax with total tax liability when filing a return.Learners will gain the confidence to analyze a pay stub, use a tax formula to estimate annual tax, and properly complete or revise a W-4 to reflect their specific situation.

Who this course is for

Anybody who wants to Learn about Taxes

Accounting Students, Tax Professionals, Enrolled Agents & CPA's